Let’s start with India:

What do we know about market crashes?

- 1992 – Harshad Mehta Scam: One of the most infamous stock market crashes in Indian history occurred in 1992, following the revelation of a massive securities scam orchestrated by stockbroker Harshad Mehta. Mehta exploited loopholes in the banking system to manipulate the stock market, resulting in a sharp decline in stock prices when the scam was uncovered. The Securities and Exchange Board of India (SEBI) initiated reforms and tightened regulations in the aftermath of this event.

- 2008 – Global Financial Crisis: While the 2008 financial crisis originated in the United States, its impact was felt worldwide, including in India. The Indian stock market experienced significant declines as foreign institutional investors withdrew funds amid global economic uncertainty. The Sensex, India’s benchmark stock index, dropped by over 50% from its peak in January 2008 to its low in October 2008. However, the Indian government and Reserve Bank of India (RBI) implemented various measures to stabilize the economy and mitigate the impact of the crisis.

- 2013 – Taper Tantrum: In 2013, India faced a market downturn as a result of the “taper tantrum,” triggered by concerns over the U.S. Federal Reserve’s plans to taper its quantitative easing program. This led to a sharp depreciation of the Indian rupee and capital outflows from emerging markets, including India. The Sensex experienced significant volatility during this period.

- 2020 – COVID-19 Pandemic: Similar to global markets, the Indian stock market experienced a sharp decline in early 2020 due to the outbreak of the COVID-19 pandemic. The Sensex plummeted by over 35% from its peak in January 2020 to its low in March 2020. The Indian government and RBI implemented various fiscal and monetary measures to support the economy and financial markets, leading to a partial recovery later in the year.

let’s delve into the key loopholes exploited in each of the major financial scams in India and the subsequent regulatory measures taken to address them:

- Harshad Mehta Scam (1992):

- Loopholes Exploited:

- Ready Forward (RF) Transactions: Harshad Mehta manipulated the banking system’s RF mechanism to artificially inflate stock prices by utilizing funds meant for short-term lending to buy shares.

- Bank Receipts (BRs): Mehta used BRs issued by banks as collateral to raise funds, which were then used for market manipulation.

- Regulatory Oversight: There were gaps in regulatory oversight and surveillance, allowing Mehta to operate without detection for a prolonged period.

- Regulatory Response:

- Strengthening of SEBI: The Securities and Exchange Board of India (SEBI) was empowered with more authority to regulate and monitor the securities market.

- Tightening of Banking Regulations: The Reserve Bank of India (RBI) introduced reforms to enhance banking regulations and oversight, including stricter monitoring of inter-bank transactions.

- Introduction of Technology: Investments were made in technology infrastructure for surveillance and real-time monitoring of market activities.

- Loopholes Exploited:

- Ketan Parekh Scam (2001):

- Loopholes Exploited:

- Collusion with Banks: Ketan Parekh colluded with officials in cooperative banks to borrow funds for stock market manipulation.

- Circular Trading: Parekh engaged in circular trading, where stocks were traded among connected entities to create artificial demand and inflate prices.

- Insider Trading: Parekh was involved in insider trading by obtaining confidential information and manipulating stock prices based on such information.

- Regulatory Response:

- Strengthening of Insider Trading Regulations: SEBI introduced stricter regulations and surveillance mechanisms to prevent insider trading and market manipulation.

- Enhanced Oversight of Banks: RBI implemented measures to improve oversight of cooperative banks and prevent misuse of banking channels for speculative activities.

- Enforcement Actions: SEBI took enforcement actions against individuals and entities involved in market manipulation, including Ketan Parekh.

- Loopholes Exploited:

- Satyam Scandal (2009):

- Loopholes Exploited:

- Falsification of Financial Statements: Satyam’s founder, Ramalinga Raju, falsified the company’s financial statements to inflate revenues and profits.

- Lack of Corporate Governance: There were deficiencies in corporate governance practices at Satyam, including inadequate board oversight and internal controls.

- Auditor Complicity: The external auditors failed to detect and report the accounting irregularities at Satyam, raising questions about their independence and diligence.

- Regulatory Response:

- Strengthening of Corporate Governance: SEBI mandated stricter corporate governance norms for listed companies, including enhanced board independence and transparency in financial reporting.

- Auditor Oversight: Measures were introduced to strengthen oversight of auditors and improve audit quality, including rotation of audit firms and increased scrutiny of audit processes.

- Legal Reforms: The Companies Act was amended to enhance penalties for corporate fraud and strengthen regulatory oversight of corporate affairs.

- Loopholes Exploited:

These regulatory responses aimed to address the specific loopholes and weaknesses exposed by each scandal, with a focus on enhancing transparency, accountability, and investor protection in the Indian financial markets. However, regulatory authorities continue to adapt and evolve their frameworks to address emerging risks and safeguard market integrity.

During the Harshad Mehta scam of 1992, several regulatory loopholes and weaknesses in the Indian financial system were exploited by Harshad Mehta and his associates. Some of the key loopholes that were exploited include:

- Ready Forward (RF) Transactions: Mehta used ready forward (RF) transactions, a mechanism intended for short-term borrowing and lending of securities between banks and financial institutions, to manipulate stock prices. By exploiting discrepancies in the settlement process of RF transactions, Mehta and his associates were able to artificially inflate stock prices and manipulate the stock market.

- Bank Receipts (BRs): Mehta utilized bank receipts (BRs) issued by banks against securities as collateral for raising funds from other banks. These BRs were then used to artificially inflate the liquidity and value of stocks in the market, leading to a speculative bubble.

- Regulatory Oversight and Surveillance: Regulatory oversight and surveillance mechanisms were inadequate at the time, allowing Mehta to carry out his manipulative activities without being detected for a significant period. There were lapses in monitoring and enforcement by regulatory bodies such as the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI).

In response to the Harshad Mehta scam and subsequent market manipulations, several reforms and regulatory measures were introduced to strengthen the Indian financial system and address the loopholes exploited by Mehta:

- Securities Scam Investigations and Reforms: Following the scam, extensive investigations were conducted by government agencies and regulatory bodies to identify the perpetrators and assess the extent of market manipulation. Reforms were subsequently implemented to enhance transparency, accountability, and investor protection in the securities market.

- SEBI Regulation and Oversight: The role and powers of SEBI, the primary regulatory authority for the securities market in India, were strengthened to improve market surveillance, enforcement, and investor education. SEBI introduced stricter regulations and surveillance mechanisms to prevent market manipulation and insider trading.

- Banking Reforms and Risk Management: The RBI implemented reforms to strengthen banking regulations, risk management practices, and oversight of financial institutions. Measures were introduced to enhance the monitoring of inter-bank transactions and prevent misuse of banking channels for market manipulation.

- Technology and Surveillance Infrastructure: Investments were made in technology infrastructure and surveillance systems to enhance market monitoring and detection of irregularities or abnormal trading patterns. Automated surveillance systems were introduced to detect suspicious activities and potential market manipulation in real-time.

While these measures have significantly improved the regulatory framework and oversight mechanisms in the Indian financial system, it is important to continuously assess and strengthen regulations to adapt to evolving market dynamics and emerging risks. Regulatory authorities remain vigilant in monitoring market activities and addressing potential loopholes or vulnerabilities to safeguard the integrity and stability of the Indian financial markets.

In poker, raising the stakes serves multiple purposes, one of which is indeed to discourage opponents from continuing to invest in the hand. When a player raises, they increase the amount of money required for opponents to stay in the hand, thus making it more expensive for them to continue. This can influence opponents’ decisions in several ways:

- Financial Pressure: Raising increases the cost of staying in the hand, especially if opponents perceive the raise as significant relative to the size of the current pot. This can put financial pressure on opponents who may not be willing to risk more money on a hand that they are uncertain about.

- Risk Consideration: Players may become more cautious when facing a raise, as it suggests that the raiser likely has a strong hand. This can lead opponents to fold weaker hands to avoid risking further losses.

- Psychological Impact: Raising can have a psychological impact on opponents, making them doubt the strength of their own hands or the likelihood of winning the pot. This can lead to hesitation or indecision, ultimately influencing their decision to continue investing in the hand.

- Information Gathering: Raising can also serve as a strategic move to gather information about opponents’ hands. By observing their reactions to the raise and their subsequent actions, a player can gain insights into the strength of their opponents’ hands and adjust their own strategy accordingly.

Overall, raising the stakes in poker is a versatile tool used by players to exert pressure on opponents, extract value from strong hands, and manipulate the dynamics of the game to their advantage. It is a fundamental aspect of poker strategy that requires careful consideration of both the cards in hand and the psychology of opponents.

Mastering Investment Confidence: Strategies for Success in Volatile Markets

Introduction: In the dynamic world of investing, confidence and conviction are paramount. They’re not just personal attributes but essential tools for navigating market volatility. This blog delves into a specific investment strategy aimed at maximizing returns amidst market fluctuations.

1. The Pumping Strategy: This strategy involves consistently investing in a stock as its price rises, regardless of previous purchase prices. The goal is to support the stock’s price and capitalize on its long-term growth potential.

2. Buying at Higher Levels: Even if the stock’s price experiences temporary declines, the investor continues to pump funds into the stock, maintaining confidence in its underlying value. This approach requires unwavering conviction in the stock’s prospects and may involve continued investment during periods of market volatility.

3. Maximizing Returns: By continually investing at higher price points, the investor aims to capitalize on the stock’s upward trajectory and potentially achieve substantial gains over time. Additionally, the investor anticipates that less affluent investors may be priced out as the stock’s price reaches higher levels, potentially leading to significant returns for those who maintain their conviction.

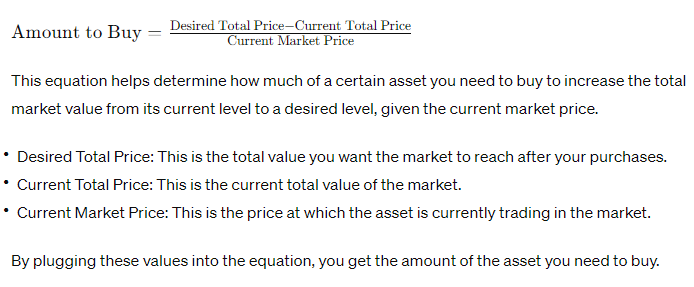

Now you can use this equation, it’s pretty simple:

Conclusion: In the tumultuous world of investing, confidence and conviction are essential for success. The pumping strategy, which involves consistently investing in a stock as its price rises, offers a unique approach to navigating market volatility and maximizing returns over the long term. By prioritizing unwavering confidence in their investment thesis, investors can potentially achieve significant gains and thrive amidst market uncertainties.

Navigating Contradictions: Our Journey from Selling Cheap to Sitting on the Board

In the fast-paced world of investing, success often hinges on our ability to navigate contradictions and find opportunity amid uncertainty. Our collective journey in the investment world embodies this principle, as we’ve experienced firsthand the twists and turns of market dynamics and the unexpected outcomes that can arise from seemingly contradictory actions.

Embracing the “Buy Low, Sell High” Mantra

Like many investors, we initially embraced the timeless wisdom of buying low and selling high. This principle served as our guiding light in navigating the complexities of the stock market, as we sought to capitalize on undervalued assets and maximize returns for ourselves and fellow investors.

A Departure from Convention

However, our journey took an unexpected turn when our investment decisions appeared to deviate from the traditional “buy low, sell high” strategy. Instead of purchasing stocks at their lowest prices and selling them at their peak, we found ourselves making investments that contradicted this principle.

The Role of Selling Cheap and Buying High

At first glance, our actions may seem counterintuitive: buying stocks at their highest prices and subsequently selling them at a loss. However, these seemingly paradoxical decisions were driven by a broader vision and an understanding of market dynamics.

Driving Market Dynamics

Our role in selling cheap and buying high was not simply a matter of individual investment decisions; rather, it was part of a larger narrative that influenced market dynamics. By attracting attention to certain stocks and spurring increased interest and investment from others, our actions contributed to the overall growth and value creation within the market.

Contributing to Positive Outcomes

While our personal investments may not have followed the conventional wisdom, they ultimately led to positive outcomes for both ourselves and other investors. The increased demand for the stocks we invested in resulted in appreciation, benefiting all stakeholders involved.

A Lesson in Adaptability

Our journey underscores the importance of adaptability and the recognition that successful investing often requires navigating contradictions and embracing complexity. By understanding the broader context of market dynamics and recognizing opportunities for value creation, investors can achieve success even in the face of uncertainty.

Conclusion: Finding Opportunity in Contradictions

While it’s true that the conventional wisdom suggests buying assets at low prices and selling them at higher prices to profit from market appreciation, individual investment decisions may not always align with this principle. There can be various reasons why someone might buy high and sell low:

- Market Timing: Investors may be influenced by short-term market trends or sentiment, leading them to buy stocks when prices are already high, expecting further appreciation. However, if the market sentiment changes or if the stocks don’t perform as expected, they may end up selling at lower prices.

- Lack of Information: Some investors may not have access to comprehensive market information or may not conduct thorough research before making investment decisions. This can lead to buying stocks at high prices without fully understanding their underlying value or potential risks.

- Emotional Factors: Emotions such as fear, greed, or panic can influence investment decisions, causing individuals to buy stocks when prices are high due to fear of missing out (FOMO) or sell at lower prices during market downturns due to panic or loss aversion.

- Herd Mentality: Investors may follow the crowd and buy stocks that are already trading at high prices because they see others doing the same. However, this herd behavior can lead to buying at inflated prices and selling at lower prices when the herd sentiment reverses.

- Lack of Discipline: Some investors may lack discipline in adhering to their investment strategies or risk management principles, leading them to buy or sell stocks impulsively without considering the long-term implications.

If individuals consistently buy stocks at prices higher than the prevailing market price and sell them at prices higher than what they paid, it could indicate several possibilities:

- Market Order Execution: Sometimes, due to market volatility or delays in order execution, individuals may end up buying stocks at slightly higher prices than the current market price. Similarly, when selling stocks, they may receive slightly higher prices due to order execution discrepancies.

- Limit Orders: Investors may use limit orders to buy or sell stocks at specific prices. If they set their buy limit orders above the current market price and sell limit orders below the market price, they may still execute trades at prices higher than what they paid, even though they appear to be buying higher and selling lower relative to the current market price.

- Timing and Analysis: It’s possible that individuals have insights or analysis suggesting that the current market price does not accurately reflect the true value of the stock. Therefore, they may be willing to buy at higher prices based on their assessment of the stock’s potential for future growth, and subsequently sell at higher prices when their analysis indicates that the stock is overvalued.

- Market Trends: In certain market conditions, stocks may experience upward trends where prices consistently rise over time. In such cases, individuals may buy stocks at higher prices with the expectation that prices will continue to increase, allowing them to sell at even higher prices later.

- Market Liquidity: In illiquid markets or for thinly traded stocks, individuals may need to pay higher prices to acquire shares due to limited supply. Similarly, they may be able to sell shares at higher prices if there is strong demand from buyers.

In the ever-changing landscape of the investment world, contradictions abound, and success often lies in our ability to navigate them. Our journey from selling cheap to sitting on the board is a testament to the power of embracing complexity, recognizing opportunity where others see contradiction, and ultimately driving positive outcomes for all stakeholders involved. As we continue to navigate the twists and turns of the market, let us remember that contradictions are not obstacles but rather opportunities waiting to be seized.

Buying higher than the market price and selling lower than the market price goes against the fundamental principle of successful investing, which is to buy low and sell high. If individuals consistently engage in such actions, it suggests that their investment decisions may not be aligned with traditional investment strategies. Here are some potential reasons why individuals might buy higher and sell lower:

- FOMO (Fear of Missing Out): Investors may feel pressure to enter the market when prices are already high due to fear of missing out on potential gains. This can lead them to buy at inflated prices, even though it goes against rational decision-making.

- Chasing Momentum: Some investors may follow the momentum of a rising stock price, hoping to profit from further price increases. However, momentum investing can be risky, as it often involves buying at peak prices and selling at lower prices once momentum slows or reverses.

- Lack of Patience: Investors who lack patience may become impatient with their investments and sell at the first sign of price decline, regardless of the underlying fundamentals of the stock. This impulsive behavior can result in selling at lower prices than initially paid.

- Market Manipulation: In some cases, market manipulation or insider trading may influence stock prices, causing investors to buy at artificially inflated prices and subsequently sell at lower prices when the manipulation is no longer sustainable.

- Inadequate Research: Investors who fail to conduct thorough research or analysis before making investment decisions may end up buying stocks at higher prices without fully understanding their true value. Similarly, they may sell at lower prices due to panic or lack of conviction in their investment thesis.

While buying higher and selling lower may occasionally result in short-term gains, it is generally not a sustainable or advisable investment strategy. Successful investing requires discipline, patience, and a focus on long-term value creation. Investors should strive to buy stocks at prices below their intrinsic value and sell them at prices that reflect their true worth, rather than chasing short-term market trends or succumbing to emotional impulses.

While buying higher than the market price and selling lower than the market price may not be a common or advisable investment strategy, there can be instances where individuals engage in such actions for various reasons, including market inefficiencies, short-term opportunities, or altruistic motives. However, it’s important to recognize that consistently buying high and selling low is generally not conducive to long-term investment success.

Here are some potential scenarios where individuals might engage in such actions:

- Market Inefficiencies: In certain cases, market inefficiencies or anomalies may allow individuals to profit from buying higher and selling lower. For example, arbitrage opportunities or mispriced securities may temporarily present opportunities for investors to exploit price discrepancies.

- Short-Term Trading: Some investors may engage in short-term trading strategies, such as day trading or swing trading, where they aim to profit from short-term price fluctuations. While these strategies may involve buying and selling at prices higher and lower than the market price, they require a high level of skill, timing, and risk management.

- Market Making: Market makers play a crucial role in providing liquidity to financial markets by continuously quoting buy and sell prices for securities. In certain cases, market makers may buy securities at higher prices and sell them at lower prices to facilitate trading activity and ensure market liquidity.

- Altruistic Motives: In rare cases, individuals may engage in transactions that involve buying higher and selling lower for altruistic reasons, such as supporting a charitable cause or helping a friend or family member in need. While these actions may not be driven by profit motives, they still involve financial transactions that deviate from conventional investment strategies.

While there may be occasional instances where buying higher and selling lower serves a specific purpose or achieves a desired outcome, it’s important for investors to approach investment decisions with a clear understanding of their objectives, risk tolerance, and long-term investment horizon. Consistently adhering to disciplined investment principles, conducting thorough research, and exercising patience are key to achieving sustainable investment success over time.

Now, let’s go outside India:

- 1929 – The Great Depression: This crash was caused by a combination of factors, including over-speculation in the stock market, excessive borrowing for stock purchases, a contraction in industrial production, and a banking crisis. The market took more than two decades to recover due to the severity of the economic downturn.

- 1987 – Black Monday: This crash was primarily attributed to investor panic triggered by a combination of factors, including overvaluation of stocks, rising interest rates, and computerized trading strategies gone wrong. The market recovered relatively quickly within two years, aided by regulatory measures implemented to prevent similar crashes.

- 2000 – Dot-Com Bubble Burst: The burst of the Dot-Com Bubble was caused by excessive speculation and overvaluation of internet-related stocks during the late 1990s. When many of these companies failed to deliver on their promises, stock prices plummeted. The market took seven years to recover as investors regained confidence in the market.

- 2008 – Financial Crisis: The 2008 crash stemmed from the collapse of the housing bubble and subsequent financial crisis, driven by subprime mortgage lending and complex financial products. This led to widespread bank failures, a credit crunch, and a global economic downturn. The market took two years to recover after significant intervention by governments and central banks.

- 2020 – COVID-19 Pandemic: The market crash in 2020 was triggered by the rapid spread of the COVID-19 pandemic, which led to widespread economic shutdowns, disruptions to supply chains, and investor uncertainty. Government stimulus measures and optimism about vaccine development helped fuel a relatively swift recovery within six months.

If we were in the market back then, these scams wouldn’t have happened. Not repeating the strategy, but it’s a strategy you can use to navigate through anything.

#WhatAreWe? #Tribal